You probably won’t be shocked to hear that homeowners in catastrophe-prone states like Florida and Louisiana typically pay more for their insurance. What may be a surprise is just how much home hardening can help keep costs down.

Hardening your home against risk reduces your likelihood of filing a claim. That’s a win for you because it helps you control your insurance costs while also saving you from dealing with repairs. But fewer claims is also a win for your insurance company, which is why so many give discounts for home hardening.

We’ve put together a list of our top home hardening tips. But first, let’s get on the same page about what home hardening is.

What is home hardening?

“Home hardening” refers to steps you can take to make your house more resilient against risks that may damage it. That often means identifying your home’s vulnerabilities and using better building materials and practices to reinforce them long before trouble approaches. In some cases, hardening your home brings it in line with modern building codes.

Homes are often vulnerable at entry points, like windows and doors. But you also want to consider other types of perils your home may face. For example, if you live along a coastline, you probably know that your roof can also be vulnerable to high winds.

We organized our home hardening tips by peril, so you can focus on the risks most common in your area.

Hurricanes and windstorms

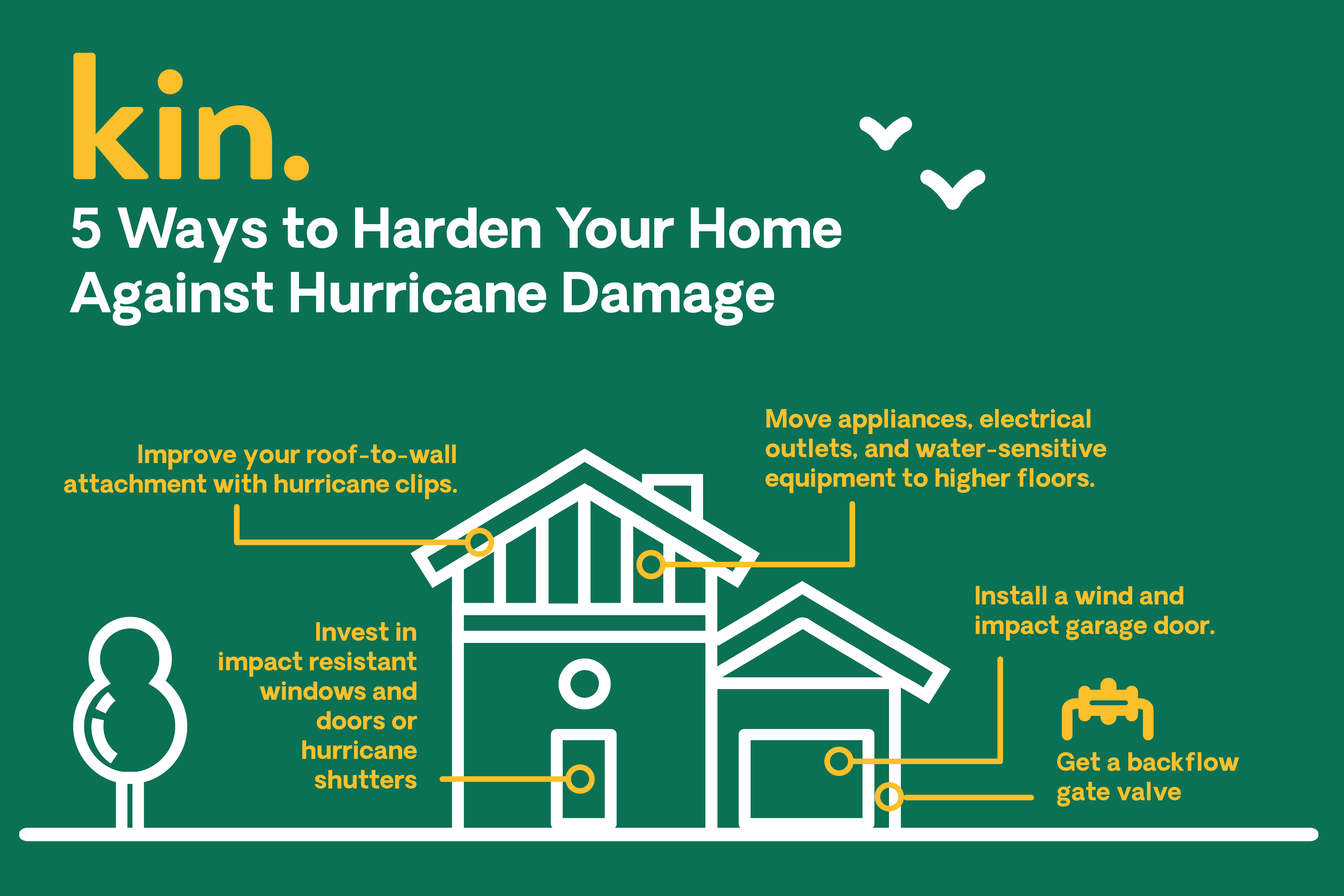

Our customers in Florida, Louisiana, and South Carolina face more risk for hurricanes than much of the nation. If you’re one of them, hardening your homes against hurricanes and windstorms is a top priority. You can start by:

- Investing in impact-resistant windows and doors. If that’s out of reach, hurricane shutters are your next best bet.

- Getting a professional to install hurricane clips.

- Installing a wind- and impact-rated garage door.

- Checking that your soffits were property installed.

- Retrofitting gable ends.

Hardening your home against hurricanes and windstorms is so important in many catastrophe-prone areas that state legislators create incentives for wind mitigation. These can come in the form of grant programs, insurance premium discounts, and tax breaks. Below are a few examples of the incentives we've found for wind mitigation.

Florida

The My Safe Florida Home Program provides free hurricane inspections to Florida homeowners. In some areas, eligible homeowners can also apply for a matching grant to retrofit their homes.

To be eligible for a matching grant, you must have been granted a homestead exemption and agree to make your home available for inspection once a mitigation project has been completed.

Additionally, your home must:

- Have an insured value of $500,000 or less.

- Have undergone an acceptable hurricane mitigation inspection after July 1, 2008.

- Be located in the “wind-borne debris region” as that term is defined in the Florida building code.

- Have a building permit application for initial construction of the home must have been made before March 1, 2002.

You can also save money on your homeowners in Florida when you mitigate your wind risk, so talk to your insurer about discounts.

Louisiana

The Louisiana Department of Insurance offers storm mitigation incentives to eligible homeowners who voluntarily harden their homes against hurricanes. These include:

- State tax deductions. Homeowners who retrofit their properties so they’re compliant with the State Uniform Construction Code may be eligible for a tax deduction equal to 50% of the cost of retrofitting, minus any other state, municipal, or federal incentives. The deduction is not available for rental properties.

- Sales tax exclusions. Hurricane storm shutters are excluded from sales tax in Louisiana.

- Premium discounts. Insurance companies are required to offer discounts on Louisiana homeowners insurance on homes that are built or retrofitted to comply with the State Uniform Construction Code. Homeowners who make install damage mitigation improvements or who retrofit their homes using construction methods to reduce wind damage may also be eligible for premium discounts.

Insurance companies may ask homeowners who want premium discounts to complete a Louisiana Hurricane Loss Mitigation Form.

Read more about Louisiana wind mitigation inspections.

South Carolina

State law requires insures to offer premium discounts on South Carolina homeowners insurance for wind mitigation, with an average maximum credit of 48% in coastal communities.

South Carolina also offers the SC Safe Home Mitigation Grant Program. Administered by the state’s Department of Insurance, the program provides matching and non-matching funds for homeowners who harden their homes against hurricane winds. The grants are only available for owner-occupied, single-family homes and only apply to retrofitting.

South Carolina homeowners can also earn tax credits for:

- Retrofit project costs. The maximum credit available for project expenses like labor and materials is either 25% of the total costs or $1,000, whichever is less.

- Retrofit supplies costs. Homeowners can get a tax credit of up to $1,500 on the purchase of tangible personal property used in a qualified fortification project.

Qualified fortification projects must be on your legal residence and include things like roof covering construction and renovations on roof attachments, roof-to-wall attachments, secondary water resistance, and opening protections.

Want more details? Check out our page on South Carolina wind mitigation inspections.

Mississippi

Wind mitigation can also get you a discount on your home insurance in Mississippi through the state’s wind mitigation program. It offers a free inspection that:

- Describes ways you can harden your home against wind damage.

- Includes an estimate of how much those improvements will cost.

- Estimates the available insurance discounts.

- Provides a hurricane rating for your home.

Homeowners who take part in the program may be eligible for matching grants to reimburse you for the cost of the improvements. Read more about Mississippi's wind mitigation program.

Alabama

Homeowners in Alabama can also qualify for discounts of up to 60% on their wind insurance premiums by fortifying their homes against potential windstorm and hurricane damage. Some of the windstorm damage mitigation steps, set forth by the Alabama Department of Insurance, to get the highest discounts – which, incidentally, require the most significant hardening – include:

-

Bracing all gables and gable end walls more than 48 inches.

-

Connecting roof framing to beams/walls, from beam to column and column to structure below.

-

Installing qualified opening protection systems on all windows, exterior doors, and skylight openings.

-

Installing windows, skylights, and glass doors rated for design pressures adequate for your home’s exposure category, wind speed, and window size and location.

-

Connecting all chimneys to roof structures to resist loads based on site design wind speed and exposure category.

-

Ensuring all walls have at least 7/16 inch structure sheathing (either OSB or plywood).

Learn more about the Alabama wind mitigation program.

Flooding

Home insurance generally only covers sudden, accidental water damage from internal sources (like a pipe bursting), so hardening your home against flooding is important. This may be particularly true if you live near the coast and need protection against storm surge, but floods can actually happen anywhere.

Long story short, you may invest in some of the fortifications to protect your home from flood damage:

- Using stilts or piers to raise your house above the flood level.

- Moving appliances, electrical outlets, and water-sensitive equipment to higher floors.

- Installing backflow or gate valves.

- Creating enclosed spaces that allow water in (i.e., wetproofing).

- Installing and maintaining a sump pump.

Wildfires

Most people think of wildfires as a problem for western states – and they’re not wrong. California saw 7,490 wildfires in 2022. But that’s not the only state where homeowners may need to harden their homes against this peril. Florida, for instance, has had 717 fires as of this writing.

Some ideas for hardening your home against wildfire include:

- Creating a defensible space around your house.

- Choosing fire resistant roofing materials, like clay, metal, or tile.

- Looking for fire resistant siding options, like stone, brick, or fiber cement.

- Covering your chimney with mesh with holes that are at least ⅜-inch wide but no more than ½-inch wide.

5 more ways to reduce home insurance claims

We highly recommend hardening your home against the risks in your area, but we also realize that a lot of these tips are pretty expensive. Some involve major renovations and most require hiring professionals, which may mean you have to save up before you can get started fortifying your home.

In the meantime, here are some additional tips to help prevent insurance claims or at least minimize damage when trouble starts:

- Get a water leak detector. Installing a water leak monitoring device can reduce damage by notifying you of a leak. Some can even shut off water to your home.

- Install gutter guards. Gutter guards keep your gutter free of debris so water can flow through easily. As a bonus, reducing the amount of debris in your gutter also makes it less likely for a flying ember to spark a flame during a wildfire.

- Buy surge protectors. A large power surge can fry your electrical system. Home insurance often covers that kind of damage, but a surge protector can save you from the headache of repairs.

- Trim your trees. Regularly pruning your trees can minimize the chance of unhealthy branches falling through your roof, especially during a storm.

- Consider a home warranty. A home warranty can address problems that home insurance doesn’t, like repairs when an appliance malfunctions. Some homeowners find that having a home warranty helps them keep small issues from becoming major claims.

While none of these can replace quality home insurance, they can go a long way toward curtailing claims and controlling your costs. Check out our other articles for more suggestions for protecting your home.