Homeowners insurance in Tampa

Protect your Tampa home. Save on coverage.

You don’t need us to tell you that Tampa is one of the best places to live. From the bustling business district to the scenic waterfront of Bayshore Boulevard, Tampa has plenty to offer the nearly 400,000 folks who call this city home.

But the charms that make Tampa so alluring also bring unique risks that make it expensive to insure the homes located here. Let’s review how much home insurance in Tampa costs and how much coverage you might need to keep your home protected.

How much is homeowners insurance in Tampa?

The average cost of homeowners insurance from admitted carriers in Florida is $3,600 per year, according to the Florida Office of Insurance Regulation. What’s more, Florida insurance rates have been rising in recent years, due to the increasing cost of:

-

Litigation.

-

Weather-related damage.

As a Tampa homeowner, you have to deal with these same issues, plus an 11% chance of experiencing a hurricane in any given year. Long story short? Chances are your home insurance premiums are around the state average.

Additional factors impacting Tampa home insurance costs

The area’s extreme wind risk is just one of several significant factors that drive the cost of home insurance in Tampa. Crime, unfortunately, is another. Tampa’s property crime rate is 16 incidents per 1,000 residents.

But these aren’t the only factors insurance companies can consider when setting your premium. They may also look at:

-

Your home’s age and condition.

-

Your roof’s age, shape, and condition.

-

Your insurance score.

-

The amount of coverage you need.

These and other issues all play a role in your overall costs.

How Kin helps you save money on home insurance

We’re a different kind of insurance provider, and the thing that truly sets us apart is our technology. We utilize more insurance data than many other providers to find you the most accurate quote that reflects the risks your home faces. This can mean lower rates for some homeowners.

Next, our customers may be eligible for several discounts, including discounts for:

-

Installing security systems and water detection devices.

Homeowners can also save money by choosing a higher deductible. In Tampa, the homeowners insurance policies we offer come with standard deductibles ranging from $500 to $50,000. Tampa homeowners can also choose from the following hurricane deductibles:

-

A flat deductible of $500.

-

A percentage deductible of 1%, 2%, 3%, 5%,10% of your Coverage A limit.

That’s why we also recommend that you get a quote and give us a shot. Our customers report saving an average of over $950 per year by switching their coverage to Kin.*

Other policies for Tampa homeowners

No insurance policy can cover everything, so you may want to consider these additional coverage options to better protect your home.

Flood insurance

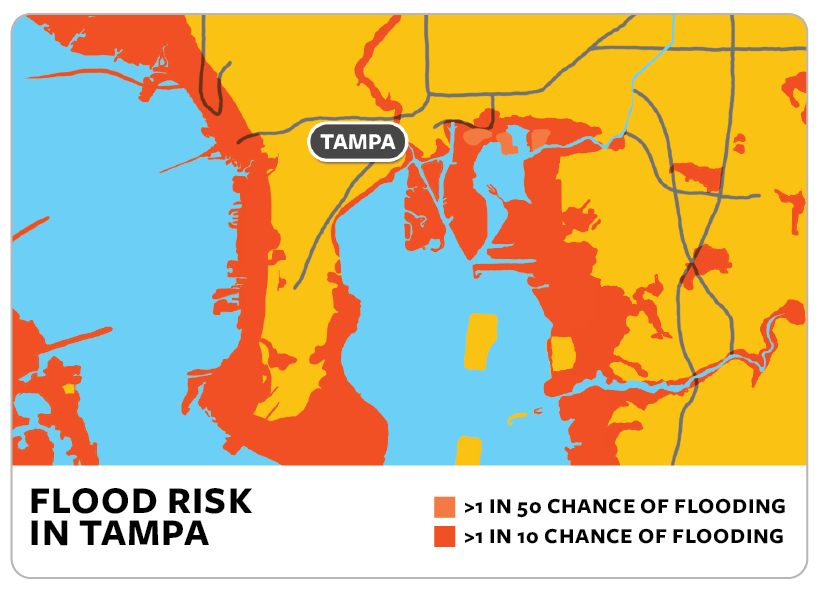

Tampa’s proximity to water leaves its homeowners exposed to flooding. The city’s lack of topographic relief exacerbates its draining issues, especially during the rainy season – the water simply has nowhere to go.

Storm surge is also a concern for Tampa residents. Low-lying areas in the city are vulnerable to storm surge, even if they don’t experience a direct hit. In fact, flood maps for the city show areas designated as Flood Zone AE and Flood Zone VE.

Taken all together, getting a quote for Florida flood insurance is a good idea. Enter your address now or give us a call at 855-717-0022 for a free quote.

Sinkhole coverage

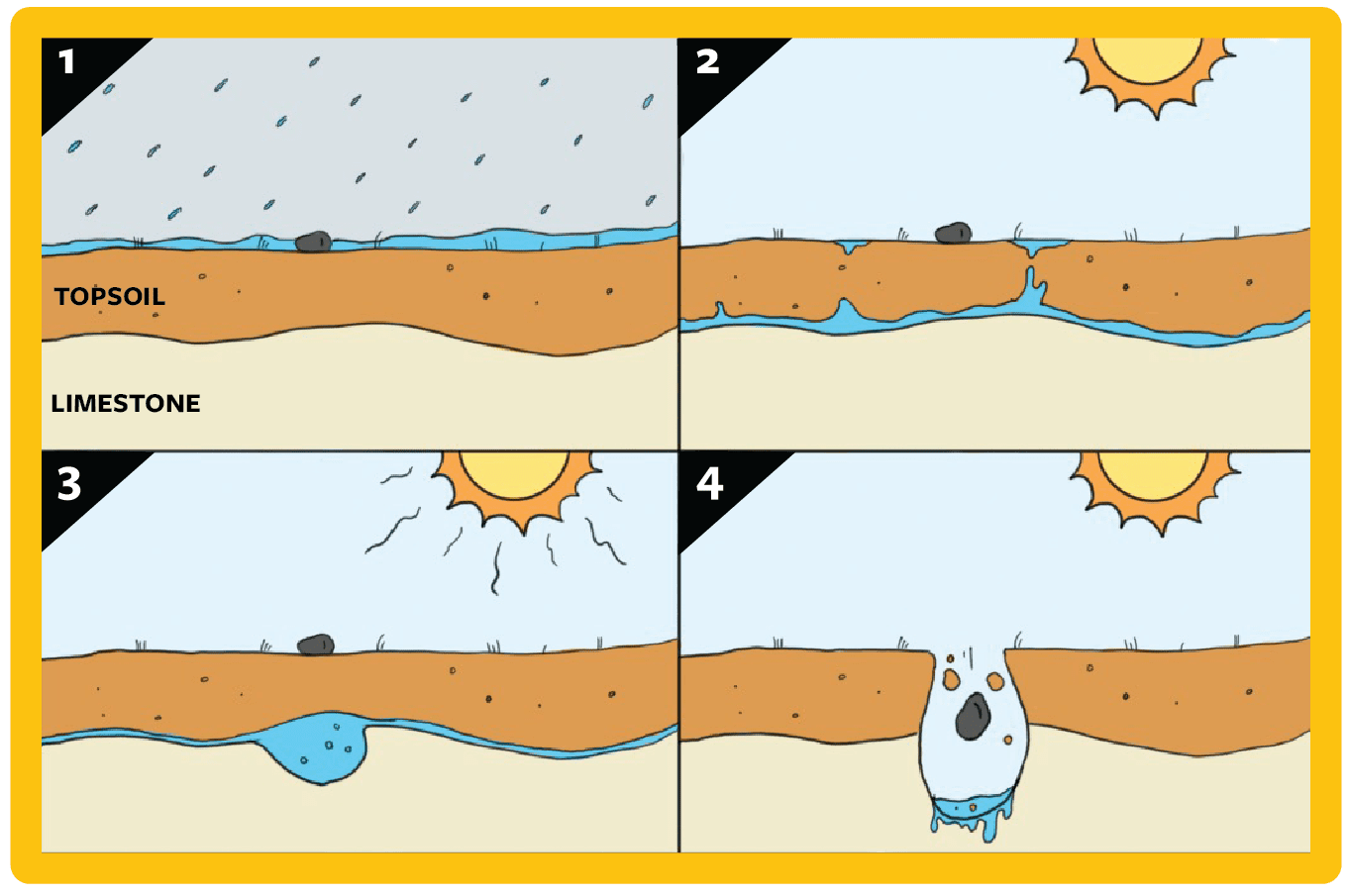

Because of its susceptibility to flooding, Tampa is also at risk for sinkholes.

The majority of Florida rests on limestone, which soaks up water during the rainy season. Water wears down this bedrock, and as the climate gets drier, the pocket formed is filled with water and no other means of support. Just like that, a sinkhole is formed.

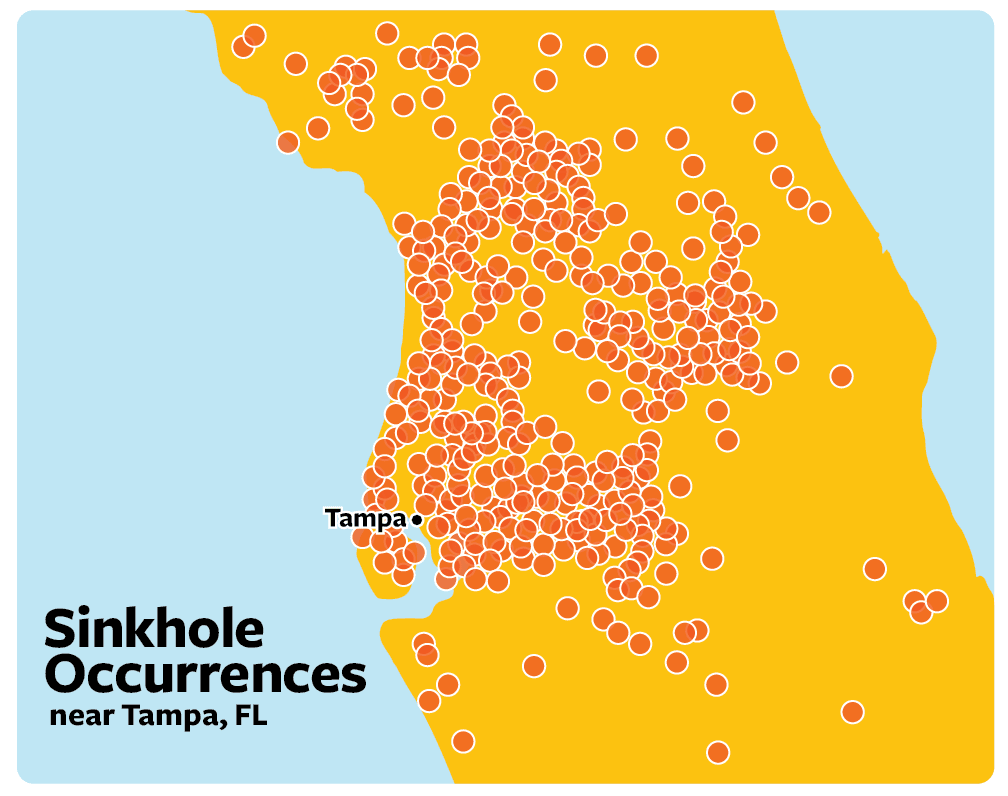

Sinkholes are extremely expensive for homeowners, usually hundreds of thousands of dollars for a single incident. The bad news? They are also increasingly common. Florida alone experiences more than 17 sinkholes per day.

Catastrophic ground cover collapse coverage is included in the policies we offer and can help cover losses caused by sinkholes in specific situations. For additional coverage, you may want to investigate sinkhole insurance.

How much homeowners insurance is enough?

How much home coverage you need depends on a variety of variables, including:

-

Your taste for risk.

-

The replacement cost of your home (i.e., how much it would cost to rebuild your home from the ground up).

-

Renovations you’ve made.

-

The worth of your personal belongings.

-

The location of your home.

-

And more.

Many homeowners make the mistake of using their home’s purchase price to determine how much coverage they need. While this can give you a general idea, it’s not the only consideration. In fact, the cost of rebuilding your home from scratch may exceed what you paid for the home, depending on the cost of construction materials and the square footage of your home.

Ask a Kin agent for guidance on the appropriate amount of coverage for your unique situation.

Home insurance FAQs

Getting the right coverage for your situation is key to protecting your home. Check out these guides for more details about home insurance.

Home insurance guides for Florida cities

| Cape Coral | Miami | St. Petersburg |

| Fort Myers | Orlando | Sarasota |

How to get home insurance in Tampa

If you’re a homeowner in the Tampa area, you can get home insurance by calling one of our experts at 855-717-0022 or entering your address here to obtain a free quote.

*Customers who switched to Kin report annual savings of $967 on average.Based on Kin Customer Savings Survey conducted December 2022 – December 2023. Potential savings may vary.

Check out how much our customers love Kin

The opinions expressed belong solely to individual reviewers and do not reflect the opinions of the Kin Insurance, Inc. group of companies or affiliates. Reviews are provided for informational purposes only.

Related Posts:Get more answers

Displaying post 1 / 3